Today I made a pretty bad mistake on my presentation. Basically, I messed up my audio shortly after I got started, and I was not aware of it for about 6 minutes or so: until I realized I was kicked out the meeting. The audio issue was caused by my airpods losing battery, and I switched to the bluetooth headset. But it appears the airpods is still connected as I did not put the airpods in the pod (partially due to presenting, and I was a bit overwhelmed). Because the airpods was making noise, my colleague dropped me from the meeting, which I did not realized as I was switch between the tabs on Chrome web broswer: the meeting was just a tab and it was not obvious.

Going forward, I am going to implement two changes: no two bluetooth devices at the same time (again due to not complete switch over or disconnecting issue); also I am going to pull out the google meet tab to its own window so that I can be made aware.

Remote working brings a lot of convenience, and it brings a lot of challenges too (remember the lawyer’s I am not a cat incident on Zoom?). One thing I think it’s important is the empathy. I think the place I am working is okay, but not perfect. Without getting too much details, I feel I did not get much support, rather received some criticisms instead. There are better ways to handle that. If I am a leader, I would handle it differently.

Author: omaha

I am Serenity and Sophia's daddy.

Covid vaccine in St. Louis county

St. Louis County COVID-19 Vaccines (pre-register)

Providers (hospitals in alphabetical order)

Precautions / things to pay attention before taking vaccines.

Ark Investments

Copied from mitbbs, link here.

======

木女神注定超越索罗斯和巴菲特,成为本世纪最大的投资传奇 Note, by Omaha aka yours truly, I disagree and I would be a bit cautious here. Warren Buffett is the best investor in the record in 20th century 1900 to 1999, no doubt about it. As to 21st century, the jury is still out, as we only had record for 20% of the century year 2000 to 2020

股海弄潮 9/916

theme_pic

secondwite

2021-01-09 12:26

楼主

这个是在10块钱买入亚马逊,30块钱买入特斯拉的女神。她在众大咖还不知道电子商务如何与物流互联网完美结合时就发现了亚马逊会一军突起;在多年前还没人能理解自动驾驶概念时就预言特斯拉的AI,大数据分析和驾驶软件会让特斯拉占据王者的地位。她甚至比马斯克自己更加看的清特斯拉的前景:在他80多(拆股前的420)想私有化时,

她再三提醒他这个价钱起码低估了10倍。幸好老马听了他的劝,不然就没有今天的世界首富。

她会是本世纪的投资女神,注定是超越利佛莫,林奇,巴菲特。索罗斯本来勉强可以与她比肩,但他过去政治化,注定无法一直在投资界伟大下去。为什么,她融合了他们的优点,但避免了他们的缺点。最重要的是,她扎住了本世纪的特质。

我知道连又些油管博主甚至本版都有许多人去年的投资汇报高于女神,但连给女神题写都

不配:她的资金接近200亿美元,以至于每个基金都被迫买入60个左右的股票,这种级

别的基金去年居然有一个月接近百分之40的回报,只能说是传奇中的传奇。

今天拜阅了木女神最新的视频

一下为她展示其投资哲学的经典视频:

======

Also

Cathie Wood discusses her investing picks, plus her insight on Reddit, GameStop, Tesla and bitcoin (youtube)

A typical day for Ark Invest’s star stock picker Cathie Wood (yahoo finance)

Cathie Wood Sees 20% Returns After ‘Unbelievable’ 2020 (youtube)

Holmdel BOE election

betterholmdeleducation (Platform)

data, media (social media, year sign, email etc)

Ladue

2012

Ladue School Board Candidate Q&A With Sheri Glantz ” If funding allows, adding the option of Chinese to our foreign language department would be a priority.” (do I hear any volunteer here? Kidding. I mean a part time Chinese instructor to be serious)

2013

5 Candidates State Their Positions on Ladue School District Issues

Jeff Kopolow, Dan Regelean Elected to the Ladue School Board (data)

2014

2015

BOE results: Glantz, Goldstein won (out of 5 candidates)

2016

BOE results: Johnson, Kopolow won (out of 3 candidates)

2017

FB: Kisha Lee: The Key to a Stronger Ladue (2017 Meet the Candidates Night; won again in 2020 run #unopposed). From my recent memory Kisha is the first African American woman to be elected to Ladue BOE. As you may have read from above, she started in 2013.

2018

Glantz and Goldstein Re-Elected to Ladue Schools Board of Education

for more detailed information on election, refer to County Board of Election (citizen can request)

2019

results (county board of election): Johnson, Kopolow won out of 3 canidates

2020: there was no election on this year and the incumbent ran #unopposed (there was no new comer). The bylaw says that if there is no bond issue, and there is no new comer, there is no need for election.

2021

Marissa Rosen 4 Ladue April 6, 2021

Board Briefs (blog)

DNC Convention, MUNY

There is no relations between those two. It’s just last night I was watching MUNY the online show for a bit, then switched to the DNC online convention: the big ones are Bernie and Michelle’s speeches. The DNC speeches were available via Apple News (ABC), as well as Twitter (PBS, CBS etc).

I used to be political junkie. But over the years especially since 2008, I became more realistic on politicians and US politics. That is until the pandemic hits, and the hell broke loose. I don’t think much of the orange guy in the WH before this, and now it suddenly the incompetency of federal government suddenly made our kids back to school seems impossible. I know many politicians have shortcomings, for example, John Edwards. His “two America” words still resonated with me, but his action during his marriage (extra marital affair when his then wife was having recurring cancer) was callous. Now the 45 is worse, obviously. With 170k people died of Covid in the US and counting, he was still playing golf. Even after his brother died over the weekend. So there is that. I do think Dems will do better. At the same time check and balance is still very important.

Back to MUNY, Serenity asked my phone back when I was watching Bernie last night, on the minivan home from church parking lot (we were playing outdoors in the evenings when possible). She was more interested in the music. Although she watched Michelle’s speech when we got home too. I haven’t asked how she feels about it. She knows my political views. I hope one day she will vote. She did ask me about voting the other day.

Where to buy masks

Masks are much more widely available, and much more widely accepted now, compared to the early days of shutdown, or in February when the US was not directly impacted by COVID. I recall buying masks at Chinese grocery store, also at the Aliexpress.com (a subsidiary of Alibaba that serves customers outside of China). Also friends in China sent in some. All those are one time use “surgical type” or “dusk” masks. The quality was okay but great. Now those are more widely available in large websites or stores as well: Amazon, Costco, Walmart etc. The price came down as well.

But I am not a big fan of one time use masks. I had one cotton mask before the pandemic, and I used it a lot (I do need to wash it more often). Recently I found those Hanes masks are good or decent. They have 50 packs as well. It comes down to $2.50 per piece. I already received it, washed it, and started using it. I think one person can use one mask per day, just like undergarments. Use Code “SAFE20” for Extra 20% Off.

Also, some kids (and their families) in Ladue school, started this stl mask project: the money raised will be donated to operation food search.

I noticed some special purpose masks such as masks for running as well. Those cost a bit more than normal ones (see below), as cotton ones could easily cause sweat.

Last but not least, I think custom made or the name on mask can have some values, especially for teachers or healthcare workers. I found Etsy have some (adult personalized mask, adult custom name mask, and reusable kids mask).

(Update 07-20-2020) Found this deal on surgical masks at ebay. I ordered 300

This IRA account was a bit unusual, as I took some meaningful losses earlier on. Then from 2017 (maybe a little bit more earlier, but I only have the balance history since Jan 3, 2017), things started to look up. In last 3.5 years, the CAGR is about 54.54%. My bigger winner during this time was $HUN, and more importantly $OKTA. This is the chart.

And the formula to do it via Google chart. Basically I imported the CSV (downloaded form broker website) into google sheet, and used the default chart, and added the formula for CAGR compound annual growth rate. Last but not least, one may adjust the formula a bit (maybe retype it), in my case, I used this formula: power (end value / beginning value, 1.0 / number of periods) . The ^ symbol (at least as I copied and pasted) seems have some issues, so I used the math power function, which is same as the ticker ^ symbol here. The period is year here, as I was looking for the annualized return.

Last but not least, this does not depict the full picture of my personal investments. I made some dumb mistakes here or there, and also, I put most of my 401k money in stock mutual funds (some in S&P 500 funds).

(Update 07-21-2020) The annual return is 13.34%, as shown in the chart. There was two meaningful drops in last 12 months. For comparison, the S&P 500 was up 9.25 % in last 12 months and Berkshire Hathaway was down -6.65% in the same period (yahoo Finance chart here).

In retrospect, I did not do well when I trade too much. One reason for more trading is since last last year, TDAmeritrade stopped the trading fees. Rohinhood was free since its beginning (2015?) and I did decently well in its early days. Then I got into sort of slump. This is similar to my main trading account (IRA at TDAmeritrade), I did well in 2017 and 2018, perhaps early half of 2019 too. But was just so-so in last 12 months (again refer to my chart). Update: actually I did not do very well in 2017 (+25%), but I did exceptional in 2018 (up 100%), then followed by 50% in year 2019. Overall still decent.

Review 401ks II

Today I started to look at other 401k accounts I have and evaluate whether I need to make any adjustments. This is a continuation of my earlier post.

In the past I do looked at them from time to time, but was not on a fixed schedule or anything. But I did start making some adjustments in last year or so, to my couple portfolios. For example, I got rid of the international funds in my Siemens 401k plan, I believe those will continue to underperform over the US equities in next 10 years or so. Most US companies are international companies too: I looked at the US large cap fund, the top 5 holdings are Microsoft, Apple, Amazon, Alphabet (Google) and Facebook. And its performance in last 1, 3, 5 and 10 years (10.5% vs 10.5% annualized) is fairly comparable to S&P index. Note in my earlier post I mentioned I am mostly keen on 10 years performance. Because we were mostly in a bull market in last 10 years (2010 to 2020). I recall Sept 2008 and March 2009 were two market lows last time around during financial crisis / great recession. So this is a bit confirmation of the market effect.

For this Siemens 401k account, I actually don’t plan to do anything today. I did update the address, since I moved from condo to current single family house in last August. I will still have a few more portfolio to look, as you can see from my linkedin profile, I changed job a bit in last 10 years or so. And I mainly used two choices when I deal with the 401k: leave them alone (for the most part); or move them to IRA (applicable to my 401k when I was in contractor position, as they usually will not let me leave the money there). I end up with 2 IRAs over the years, and a few more 401ks. Maybe at some point, I will consolidate, as management of those can become more tedious. As a minimum I need to have user name / password for them. The only place they have single sign on is the credit card company I worked for. A bit off topic, I recall a gentleman who used to work for Disney, and he said Disney has at least three SSOs. Then my colleague commented then it’s MSSOs

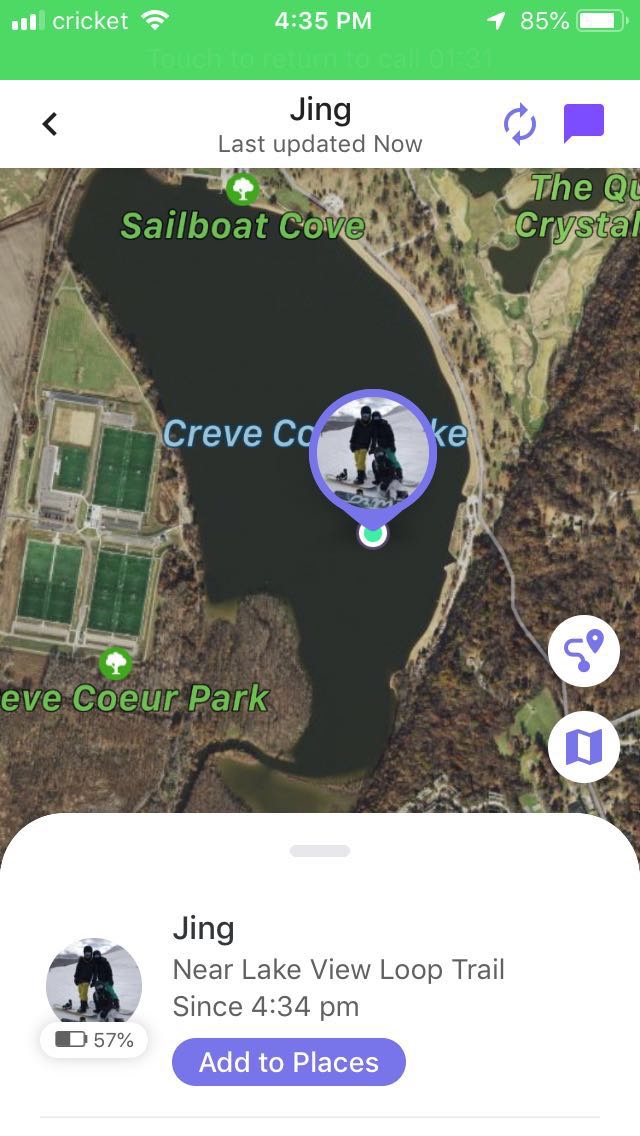

Today I had a small scare at the CC lake. I was chatting with friends while keep an eye on Sophia the 5 year old. Serenity the 10 year old went paddle boarding with friend with their moms permission. I found out after the fact, and when I asked the moms (my wife and Serenity friend’s mom), who were watching them, they said “we don’t know where they are on the lake”. This made me start to worry. Our quick response is, we rent a kayak to search on the lake. We asked around, not seeing them, increasingly worried, and even thought about calling 911. At this time I asked if we can use “find my iPhone” to find the girl, because the other girl’s mom hanged the phone on Serenity’s neck. It eventually worked, and we found them not too far from where they started, and it’s near the bank too. We were relieved, and did a bit more kayak afterwards.

My lesson here is make sure Serenity has her own iPhone, and help her learn how to use. Basically the friend’s mom called the girls twice, and the girls did not pick up the phone properly (accidentally pressed the “declined” button, thus the ensuing panic). Because this time she had friend’s mom’s iPhone on her neck while she was paddling / using the roar to push forward. And we had to call her friend’s dad to run this “find my iPhone” to pinpoint the particular device. I also want to make sure we have better network: maybe Verizon or AT&T for my whole family down the road. Right now both my wife and myself have mint mobile which uses t-mobile network, and it’s considered not as good as the VZ and T.

Serenity’s mom’s thinking is we should keep an eye on them all the time, unfortunately due to the size of this lake, it’s a bit impractical.

Covid etc

First I want to make a quick announcement, I moved my website from uudaddy.com to stlplace.com/uudaddy as I decided no longer paying for the domain name uudaddy.com. Today incidentally I found people grabbed my previous domain.

Back to topic, while the guard for Covid is way down in the US. Please note it’s not completely gone yet. In fact the cases are going up in rural Missouri and many other states such as Arizona. A few months ago I create a README.md file in the Covid repo on GitHub. The websites I used to look up the US information are still valid: 1point3acres and coronainusa . I also follow Chris Prener (a SLU professor) and he has some good updates and charts for Missouri Covid as well. Such as this one. His GitHub repo here.